Investment notes - GoPro: "I'd love to answer that, but Brian would kick me..."

A deep value play building a valuable high margin subscription business.

Disclaimer: The below does not constitute investment advice. Please do you own research or obtain your own advice. The views presented are my own. I do not own GoPro shares at the current time, but am watching them closely. I will update this disclosure if I buy the stock.

For more of my thoughts feel free to follow me on Twitter @tlginvestor or hit the button below.

This is Part 1 of my investment notes. Detailed investment merits and risks (with mitigants) will be available shortly in Part 2.

Summary

GoPro has pivoted to a D2C and hardware plus subscription business model. While subscription revenues are small, they are growing rapidly.

The business has operationally turned the corner, returning to growth, increased margins and strong cash generation. I largely credit CFO/COO Brian McGee for this turn around

GoPro has a market cap of ~$1.3bn and, after netting off cash, an EV of ~$1.1bn. It generated $1.1bn in revenue and $211m of cashflows in 2021. The business trades ~5x trailing FCF. Management has noted it plans to buy back 10% of its stock.

The share price continues languish as many investors continue to be scarred by the company’s historical mismanagement.

Overview

GoPro produces and sell action cameras. It has also develops its own mobile apps and video-editing software.

In 2002 Nick Woodman was on a surfing trip in Australia and wanted some action photography of him while surfing. The problem was that no amateur photographer could afford the equipment to zoom in close enough to get a decent picture – the inspiration behind GoPro. It took Woodman a couple of years to develop the first version of thecamera. The initial start-up capital was raised by selling beads and shell belts out of his VW van (not unlike what the Airbnb co-founders did with cereal boxes) and a $230k loan from his parents.

GoPro went public in June of 2014 and a few months later it hit its all-time high of $93.85. Since then it’s been a long and painful decline for early backers of the stock. Today the stock trades around $8 but has traded as low $2.48. The business reportedly explored a sale a couple of years ago, but nothing eventuated. The business is listed on the NYSE under the ticker $GPRO.

Investment thesis – what do I need to believe to compound capital at 20%+ annually?

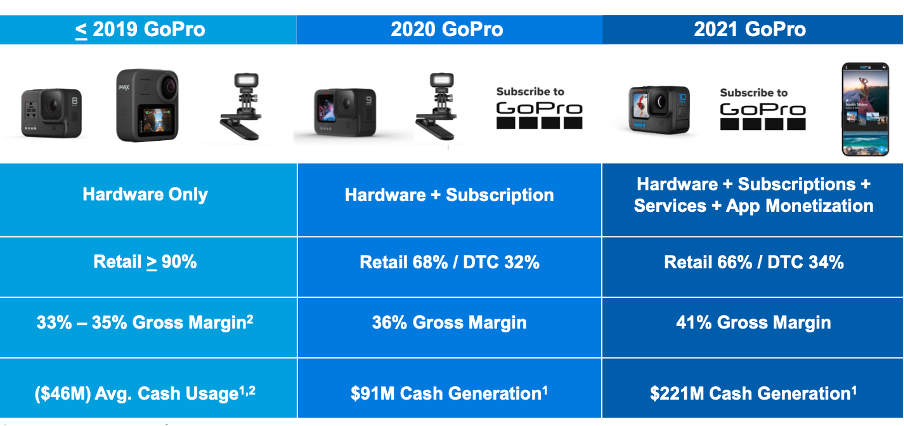

I’m not (yet) convinced this is a long term capital compounding story. This is a value play. GoPro has gone through a step change in terms of its business model. Historically the company was focussed on selling hardware products via retailers. This revenue is lower margin and one off in nature. Today the business has pivoted to selling a direct to consumer model (alongside third party retailers) as well as a hardware plus subscription model. The business has also returned to growth, with TTM revenues growing in the last 4 quarters, while generating ~18% FCF margins in 2021. The operational turn around in my view has been driven by its CFO/COO Brian McGee, who has refocussed the business as well as cutting substantial bloat in its cost structure. Given its long run of disappointing results, GoPro is a stock that has lost trust with the market. Today it trades at ~5x TTM free cash flow, while rapidly growing its high margin subscription revenues.

My thesis is that as GoPro continues to deliver and beat expectations over the next 12 months, and as a result, the company will ultimately be rerated by the market. Management is demonstrating its new focus on strong capital allocation with buy backs to take advantage of the current discount of its shares. A multiple re rate to 10x FCF automatically doubles the value of the stock, and stock buybacks that will cover (but maybe more than) employee dilution also increases intrinsic value. Either way, I’m comfortable with there is a large margin of safety.

While not explicitly in my thesis, I do see the possibility of M&A from a strategic or financial sponsor.

First some thoughts on consumer investing

I generally struggle with consumer investing (it’s a bias I am working through). It’s not something that naturally fits with my investment philosophy and the failure rate is high. To help overcome this bias, I have spent a substantial amount of time understanding the best businesses models for consumer investing. I’ve come to the conclusion that the best consumer companies to invest have an element of purchase repeatability to them. The data set I considered (not scientific, all anecdotal!) suggested these business models are less volatile in the returns they offered / lower failure rate. To draw an analogy to a software business, the characteristics of a successful consumer investment are not that different. In SaaS investors look for high retention rates coupled with strong LTV / CAC ratios. In my view, investing in a consumer company should be no different. High retention and repeat purchase rates makes these business stronger businesses, without the need to go acquire new customers. So what does this look like? Well, we can delineate between three types of DTC consumer companies:

High Retention / Strong Recurring Spend: Hello Fresh, Spotify, Dollar Shave Club, Apple

One off in nature / No recurring spend: Casper, Away, Smile Direct Club

Everything else in between

GoPro is a vastly different business today compared to what it was at its IPO. I’d encourage folks to read its S1 to get a sense as to the business that was brought to the public markets. In short GoPro was exclusively a hardware business – and squarely fit in the “one off in nature / no recurring spend” bucket. Today GoPro operates a different business model to when it went public.

Two things have changed with GoPro:

1/ GoPro is a higher margin business and has a more resilient business model driven by diversified revenue streams

There are few things driving the step up in margins. As an overarching comment, the company used to run a very bloated cost structure. Management (driven by Brian McGee, I suspect – but more on that below) has rightsized the business in the last two years focussing on reducing OPEX as percentage of revenue by greater than half (66% to ~30%). Despite the leaner cost structure, the business has been able to increase innovation and return to growth, and management deserves credit for the turnaround there.

From a gross margin perspective GoPro has changed its business model and its product offering. Historically GoPro sold its cameras via retail stores (both big box and speciality retail). This eats away at margin and it’s one of the reasons most new consumer that have emerged are direct to consumer or DTC (Allbirds, Away, Warby Parker etc) [1]. GPRO has recently created direct to the consumer channel via its own website. In 2021 the business made 34% of its sales through its website (versus less than 10% of sales pre 2019). Along with the focus on direct to consumer, the company has tightened its product range. In the past, GoPro released a range of products per year. The company has since shifted to one key release, with older superseded models still available but at a lower price point. As a result the camera mix ASP mix for products priced greater than $300 has increased from 42% in 2018 to 87% in 2021 (94% in the fourth quarter).

The pivot to DTC has allowed GoPro to build a subscription business, a key part of the investment thesis. GoPro takes some of the additional margin it captures from going DTC and offers the consumer a discount on the hardware ($100) in exchange for them for subscribing to a $50 a year GoPro annual subscription. The annual subscription is actually quite good value. Customers get unlimited cloud backups, no question asked camera replacement (twice a year), access to its video editing app (Quik app, see below) and further discounts on the website. The subscription revenues are higher margin, with corresponding high lifetime value. While the unit economics in year one might not affect the overall margin mix (given the discount provided on hardware), I suspect year 2 onwards will be very margin accretive (~70- 80% gross margins). GoPro exited 2021 with 1.6m annual subs (up from 200k in 2018).

Finally GoPro has introduced Quik mobile app subscription a camera agnostic video creation and editing tool. The app costs $10 a year to subscribe and is essentially designed to bring non GoPro users into the GoPro ecosystem. Quik is not a meaningful contributor of revenue today but the revenue has SaaS like gross margins, and will likely provide another way to broaden the top of the funnel to sell hardware + annual subs. The app has ~221k users after being launched in the spring of 2021.

2/ Management has turned the ship around

I talk about management below, but the short of it here is that Nick Woodman (or the board) has realised that he needed to bring someone in to undo his missteps. That person is CFO and COO Brian McGee. While Woodman remains the CEO, and runs point on brand and marketing, Brian has been critical to the turnaround story driving the financial and operational aspects of the business. I’ve started to observe this dynamic in earnings calls with Woodman even deferring to McGee in cases where analysts have directed questions at himself.

The strategy is working

While I don’t intend to do a detailed overview on the financials as part of this write up, there are a couple of things I want to point out. Gross margins have increased from 33% to 41% and subscription revenues (one the drivers of this) has grown to $17m in the most recent quarter (~$68m annualised). 94% of cameras in Q4 had an ASP of more than $300. Revenue mix has also changed from predominantly 100% retail to a third DTC and two thirds retail. Additionally the business is starting to generate a material amount of cash with 18% FCF margins. Management has announced it intends to buy back 10% of its stock to cover employee dilution.

What the market is missing

While the business has turned the corner, with strong operational results in 2021, the stock continues to languish. I think this is because the market is missing two things with respect to GoPro.

1/ GoPro’s competitive moat (which I agree is less than obvious, but I think exists). There are 3 factors that come into play to support this part of the thesis:

Smart phone camera’s have not killed the GoPro: The rate of improvements in smart phone camera technology has been rapid, with most brands flagship phones being relatively waterproof and robust. Sceptics (including me once) argued once the iPhone / Galaxy would eat GoPro’s lunch. While there’s no doubting that the rise of the smartphone has impacted the size of GoPro addressable market, what has become apparent is GoPro is critical for the creator economy (and as discussed below, the rapid increasing demand for content)- for creators who run YouTube channels and vlogs, GoPro remains the hardware of choice. My diligence suggests GoPro outperforms its smart phone counterparts while offers a much cheaper alternative to professional options from traditional camera manufacturers. The rate of innovation at GoPro appears also to be back on track (despite a leaner R&D function). The business just won its 2nd Emmy for Technical & Engineering for its innovation in in-camera sensor and software stabilization technology.

The value of the brand: GoPro has an evangelical brand following. Its customers are obsessed with it. It owns the action camera market (~67% market share according to this). There are some smaller competitors, but I had never heard from them until started doing research on the stock.

The value of content to the creator economy: creators make their money by selling content and the quality of the content is critical for their ability to monetise it. GoPro continues to provide creators with tools to produce the best content. Content is cash for creators, and GoPro provides the infrastructure to support the production of it.

2/ The businesses turn around (more obvious, but anchoring bias might be playing a part here)

Management seem to have got their act together: It’s fair to say the market has rightly punished company for its history of mismanagement. My last post talked about anchoring bias, and in my view, despite the turn around in performance, GoPro is suffering the resulting perceptions of years of mismanagement. Investors have been burnt (imagine buying at $90 a share) and management has lost trust with the market.

FCF generation and capital allocation: In 2021 the business generated FCF of $211m, and ended the year with $270m of net cash. I anticipate in 2022 the business will generate greater levels of FCF. Management has said that it intends to buy back at least ~10% of its float to counter dilution from employee stock compensation. Given the current depressed value of the stock, buy backs seem sensible and should be value enhancing over the long term.

Does the business’s economics benefit from scale?

GoPro will benefit from scale on both the hardware and subscription side. The business should see costs fall on both sides with scale, but likely more on annual subscriptions (where cloud storage costs should decline).

Does the valuation make sense?

Yes. There are a couple of ways to look at this. GoPro has a market cap of ~$1.3bn and, after netting off cash, an EV of ~$1.1bn. It generated $1.1bn in revenue and $211m of cashflows in 2021. The business trades ~5x trailing FCF.

While GoPro provide a forecast for subscription revenues. We can do a back of the envelope calculation to determine subscription renewal revenues for 2022 . Subscribers have grown rapidly with annual subscription numbers up 107% to 1.6m, while Qlik has grown to 220k subscribers after only being launched in spring of 2021. We can use this to calculate that 2022 subscription revenue to be approximately $82m assuming 100% renewal (I note this calculation doesn’t take into account churn and there will obviously be some. However given subscription numbers are growing quickly, this assumption seems conservative and I suspect that subscription revenues will be more than this number).

While I don’t think it’s appropriate to ascribe a SaaS like double digit revenue multiple on the subscription revenue, given the growth rate, I do think a 5x revenue multiple is fair – suggesting the subscription revenues are worth about $400m. This basic SOTP approach would suggest the hardware business alone is valued at $700m or less than 1x revenue. That feels like a very reasonable valuation.

Thoughts on management and alignment?

Nick Woodman was rated one the worst CEO’s of 2016 and 2017. While media lists on management alone aren’t enough to justify not investing in a company, it does bring up questions. In this case, I think those ratings were justified. GoPro, under Woodman’s guide, made a number of mistakes around capital allocation, expense management, inventory management, product roadmap /execution and a swathe of others. Unsurprisingly this has been reflected in Glassdoor reviews, with Woodman receiving just a 59% CEO approval rating, and employees pointing to career growth, management and lack of innovation as key issues.

That’s where Brian McGee comes in. McGee joined in 2015 as the VP of Finance from Qualcomm before being promoted to CFO and COO. Since he became CFO the company has embarked on a strong turn around. I think McGee is effectively running the ship (without the CEO title). I have drawn this outside in conclusion from two things:

The increased focus on optimising cost structure and capital allocation of the business (both of which started to play out when McGee became CFO / COO and are clearly not Woodman’s strength).

Going back and reading the earnings call transcripts which seem to be confirming the clear delineation of each of their roles. On the Q4 2021 earnings Woodman was asked a question from an analyst about capital allocation. His response spoke volumes:

I'd love to answer that, but Brian would kick me in the shins under the table even through the phone line. So I'm going to hand that one over to Brian.

Music to my ears.

From an alignment perspective Woodman owns 17%, which is great but his compensation package is ridiculous for a company with $GPRO’s market cap (~$3m annual comp of which ~90% is stock). By comparison, Daniel Ek at Spotify made ~$500k annual comp which is all in stock.

I’ve struggled with the assessment of management quality quite a lot on this one. It’s one of the reasons I’ve not bought the stock yet. Hopefully it’s not time sunk bias, but I do think I am starting to get comfortable with this risk the more earnings calls i listen to (even if Woodman’s salary is too high).

Where could I be wrong?

Detailed risks (and mitigants) will come in Part 2, but I see 3 key areas where I could be wrong and my thesis unravels.

The company fails to continue to innovate and a cheaper brands (i.e Xiomi) offer a similar product at a much lower price point or Apple / Samsung creating a product that’s just as good integrated into their flagship phones

Subscribers don’t grow and churn increases

Management fail to execute / fall into their old habits

How might GoPro return over 10x money?

GoPro turns into predominantly a DTC company along with a 90%+ attach rate of annual subscription with a new camera purchases would create a very valuable subscription business. Conservatively assuming 3 million annual units shipped per year (likely higher) for the next 5 years , 90% annual subscription attach rate and 10% churn would yield an additional ~$600m recurring subscription revenues plus hardware sales.

[1] Along with margins, DTC models (in my view) allows a company to control its brand narrative. own the customer journey / build a direct relationship with customers and increase customer LTV.

Thanks for reading, if you enjoyed it please subscribe, refer, share or leave a comment!

Thoughtful analysis that is also well written and approachable for the novice value investor. Looking forward to reading more

Excellent write up. Can't wait for part 2!